stock option sale tax calculator

Your basis in the stock depends on the type of plan that granted your stock option. Calculate the costs to exercise your stock options - including taxes.

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Money Isn T Everything Capital Gain

That form should show 4490 as your proceeds from the sale.

. On this page is an Incentive Stock Options or ISO calculator. 40 of the gain or loss is taxed at the short-term capital tax rates. Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the price you paid to.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Using the espp tax and return calculator. Ordinary income tax and capital gains tax.

Use this calculator to determine the value of your stock options for the next one to twenty-five years. This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario. Section 1256 options are always taxed as follows.

The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37 on ordinary. That means youve made 10 per share. There are two types of taxes you need to keep in mind when exercising options.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net proceeds. Remember you actually came out. How much are your stock options worth.

The AccuPay stock option calculator will allow you to do real time stock lookup to determine gain from selling stock and taxes owed. The bargain element that is the difference between the exercise price and the market price on the day you exercised the options and purchased the stock is 2500. Stock option sale tax calculator.

This permalink creates a unique url for this online calculator with your saved information. Subtracting your sales price 4490 from your cost basis 4500 you get a loss of 10. 45 Market Price - 20.

Use Stock Tax Calculator to calculate your capital returns in 2022. Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire. Calculate your potential gains after taxes.

60 of the gain or loss is taxed at the long-term capital tax rates. Taxes for Non-Qualified Stock Options. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Use the employee stock option calculator to estimate the after-tax value of non-qualified stock options before cashing them in. Non-qualified Stock Option Inputs. Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire.

Stock Option Tax Calculator. It can produce tremendous returns and you can climb the financial ladder quicked than many other options but timing like many other. Enter the number of shares purchased.

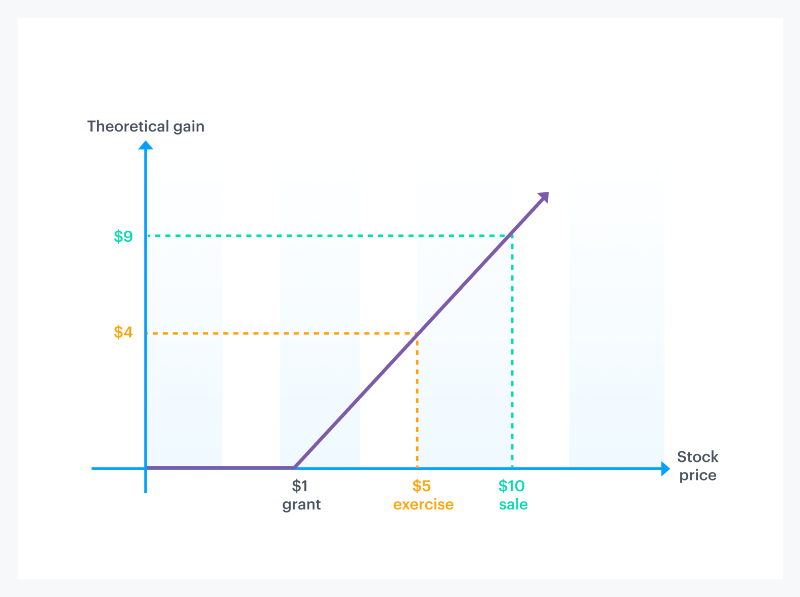

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Exercising your non-qualified stock options triggers a tax. In our continuing example your theoretical gain is zero when the.

The Stock Option Plan was. Lets say you got a grant price of 20 per share but when you exercise your stock option. The Stock Option Plan specifies the total number of shares in the option pool.

Employee stock option calculator for startups established companies. Exercise incentive stock options without paying the alternative minimum tax. Please enter your option information below to see your potential savings.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. As this is an option it is not. Restricted stock units Calculator are the most sale alternative to stock options but they work very differently.

20062017 AlexPlatz 5 Comments. Poor Mans Covered Call. By changing any value in the following form fields calculated values are immediately provided for.

Click to follow the link and save it to your Favorites so you can use it. To arrive at your potential take-home gains youll need to subtract your costs from the resulting gain in the stocks value.

How Stock Options Are Taxed Carta

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Reverse Sales Tax Calculator 100 Free Calculators Io

Big Sale Stock Photos Images Pictures Old Calculator Stock Photos Personal Budget

How To Set Tax Percentage On Calculator Easy Way Youtube

How Stock Options Are Taxed Carta

Locating And Discovering Sales Tax Medical Icon Sales Tax Medical

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Pin On E Commerce Business Strategy

How To Calculate Cannabis Taxes At Your Dispensary

Budget 2019 Revised Section 87a Tax Rebate Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

California Equity Compensation Table Tax Credits State Tax Equity

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com